By the trading on the margin, the new investor twofold the woman funds with the exact same amount of money. This can takes place when the value of the new securities from the account drops less than a specific peak, leading to a bad balance from the margin account. The level of margin that is felt secure hinges on the newest trader’s chance tolerance and you can financing wants. Change on the margin amplifies a trader’s to find power, letting them purchase far more ties than their funds harmony do generally allow.

Inside a regular dollars account, your change using only the bucks you may have on the account. Which have a good margin account, your put bucks, and this functions as the brand new security for a financial loan to find bonds. You need to use so it to help you borrow to fifty immediate-meta.com % of your cost away from a good investment. When you put $5,000, you can get as much as $10,one hundred thousand in the securities. The greater amount of qualifying property you have got on your own account, the greater amount of you could potentially use. While some stocks do not give a straight to borrowing or financing worth — including, carries trading below $3 aren’t marginable — other ties can get be eligible for that loan all the way to 70% of their most recent value.

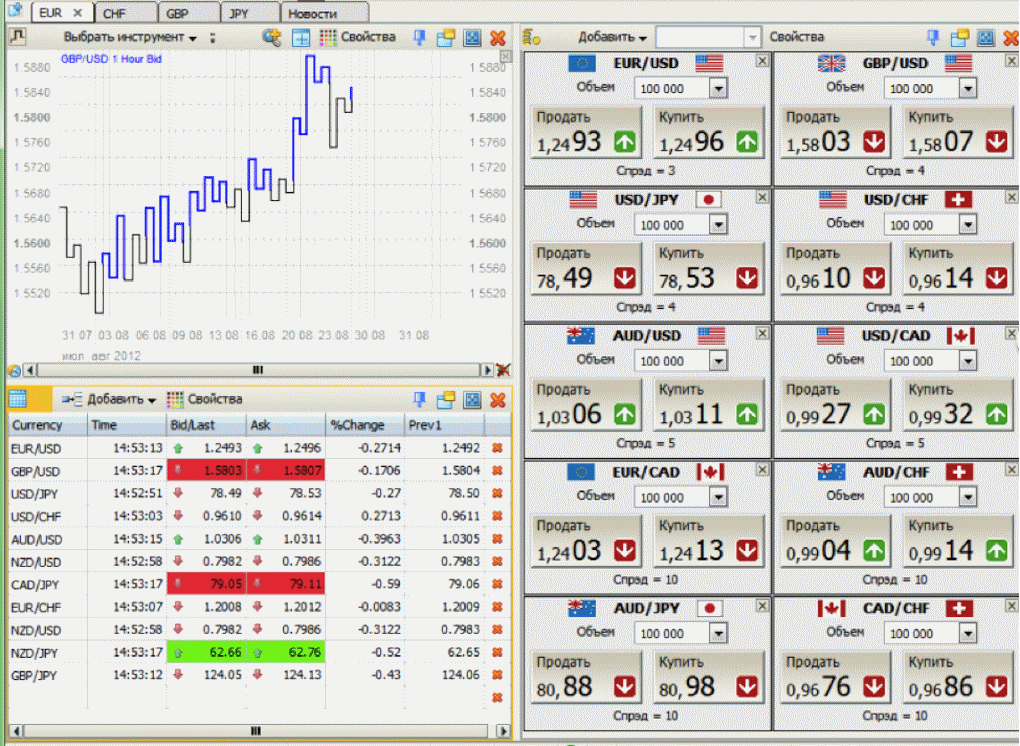

Best Margin Trade Brokers

To purchase on the margin setting borrowing from the bank funds from your own representative to shop for inventory. An investor aiming for quick development might possibly be more inclined to help you embrace highest margin membership, wishing to capitalise for the prospective business spikes. For many who’lso are currently trading for the margin, don’t ignore to utilize risk-government products to guard your account away from margin calls and you will margin closeouts. Playing with stop-losses automates their trading and you can reduces the psychological basis from your own decision making.

What happens basically is also’t shell out a margin phone call?

- Remember that guaranteed prevent-loss purchases wanted a tiny premium.

- It’s a great nuanced approach, making it possible for buyers to amplify its possible progress but also, consequently, its possible losses.

- This type of intermediaries establish and sustain margin membership whilst enforcing requirements linked to margins as the a way of measuring exposure handle.

- Because there are margin and you can guarantee conditions, investors get deal with a good margin name.

- Asktraders are a free of charge website that is supported by our adverts partners.

These are the financing on your account that aren’t being accustomed trading. How much money you would like on the overall margin membership would depend to your property value the brand new positions you will be making and you can if or not he’s already within the a profitable or loss-and then make status. And your own required margin, the level of available fund you need to unlock a trade, you might also need money to pay for on the repair margin to hold the new trading discover.

So it indicator assesses the relationship amongst the guarantee inside your margin membership plus the aggregate number of put margin by the saying they while the a share. Your arrive at that it contour because of the isolating the brand new collateral on the margin account by amount of made use of margin and then amplifying one to number one hundredfold. So you can describe the idea of margin change, let’s explore an illustration regarding the forex. Suppose you possess an excellent margin account and therefore necessitates simply a 1% margin. This allows one to create a situation well worth $one hundred,100000 from the committing just $1,100 upfront.

Your debts as well as the concentration of your own collection will influence their possible loan amount. For investors just who understand the threats and now have generous using sense, margin change can boost payouts and you may open up exchange potential. Make an effort to follow all of the margin mortgage cautions and you may don’t get into until you know exactly everything’lso are getting into. From the its key, margin change is more than just credit money to expend.

What is actually margin exchange?

If you are unable to see a good margin call by the injecting a lot more financing, their agent try authorized in order to offload your own securities to help you repair your account’s harmony to your compulsory tolerance. This step, referred to as pressed liquidation, could potentially cause your own property to be sold at the rates that can perhaps not work in your own choose and may also consequently cause you can loss. Therefore, from your own $step one,100 exchange membership, $250 is put out since the an excellent margin for selecting five-hundred carries per $ten.

The broker will provide the other people, along with your put acting as security to afford chance of your exposed position. Trade to your margin offers a quantity of exposure just like betting inside a casino. While it presents a chance to own ample development, there is an equally high possibility of serious losings. For this reason, it’s essential continue an almost view to the points of your margin membership continuously to be able to end these circumstances. To totally discover all facets of purchasing carries to your margin, you ought to find out how your debts, guarantee, margin and you will free margin are related to each other. Constantly, the method pursue certain terminology and production vibrant interest levels.

Because the bonds collateralize the loan, people price refuses decrease your guarantee and you may possibly cause an excellent margin name. Focus to the margin change is generally put in the brand new margin harmony monthly. After you offer their inventory, proceeds first lower the fresh margin mortgage and you may just what’s kept would go to the new account manager. Extreme margin calls may have a great domino influence on almost every other buyers.